Journal Entry For Selling Inventory On Account . when you sell the $100 product for cash, you would record a bookkeeping entry for a cash transaction and credit the sales revenue account for the sale. the accounting records will show the following bookkeeping entries for the sale of inventory on. This transaction transfers the $100 from expenses to revenue, which finishes the inventory bookkeeping process for the item. when it comes to inventory accounting entries, you have a few options: an inventory journal entry is a type of accounting entry that is used to record transactions related to a company’s inventory. when selling inventory, a journal entry must be made to both debit cash or accounts receivable and credit sale. pots 'n things must also add a selling inventory journal entry to show a change in the assets it holds, so now the inventory.

from www.youtube.com

when it comes to inventory accounting entries, you have a few options: the accounting records will show the following bookkeeping entries for the sale of inventory on. when you sell the $100 product for cash, you would record a bookkeeping entry for a cash transaction and credit the sales revenue account for the sale. This transaction transfers the $100 from expenses to revenue, which finishes the inventory bookkeeping process for the item. an inventory journal entry is a type of accounting entry that is used to record transactions related to a company’s inventory. when selling inventory, a journal entry must be made to both debit cash or accounts receivable and credit sale. pots 'n things must also add a selling inventory journal entry to show a change in the assets it holds, so now the inventory.

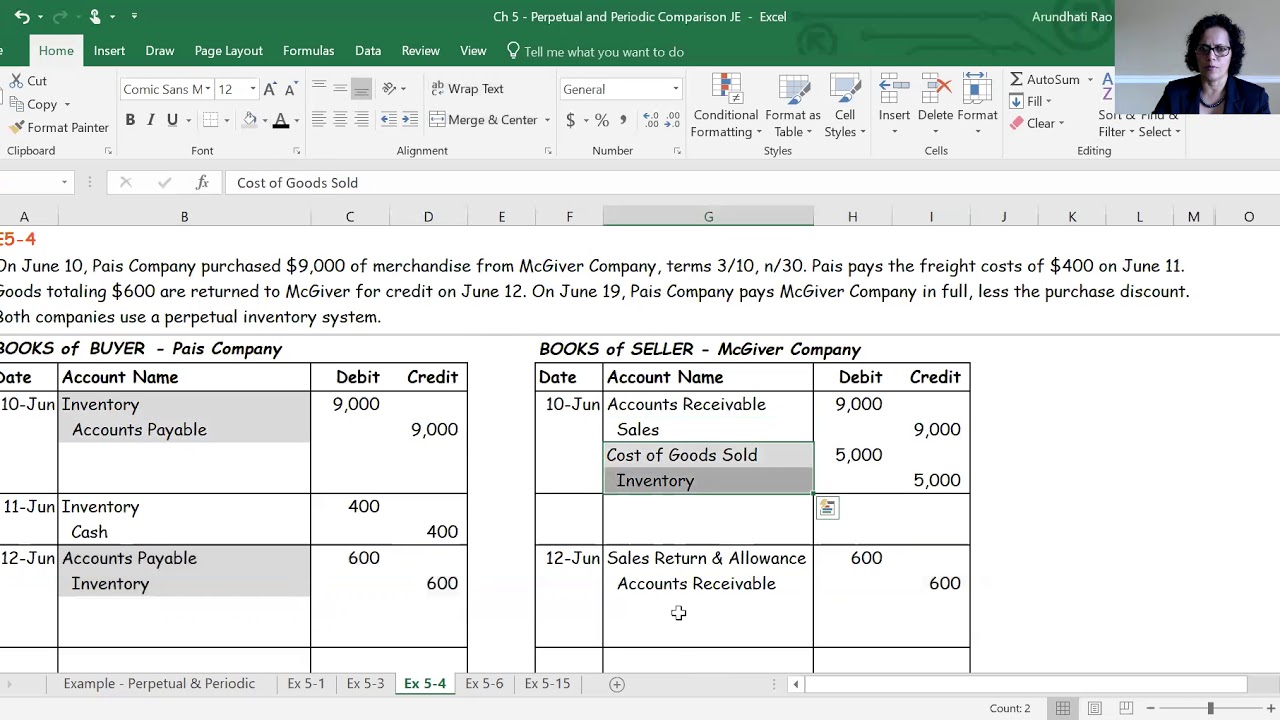

Perpetual Inventory Journal Entries Buyer & Seller YouTube

Journal Entry For Selling Inventory On Account pots 'n things must also add a selling inventory journal entry to show a change in the assets it holds, so now the inventory. when you sell the $100 product for cash, you would record a bookkeeping entry for a cash transaction and credit the sales revenue account for the sale. an inventory journal entry is a type of accounting entry that is used to record transactions related to a company’s inventory. This transaction transfers the $100 from expenses to revenue, which finishes the inventory bookkeeping process for the item. when it comes to inventory accounting entries, you have a few options: when selling inventory, a journal entry must be made to both debit cash or accounts receivable and credit sale. pots 'n things must also add a selling inventory journal entry to show a change in the assets it holds, so now the inventory. the accounting records will show the following bookkeeping entries for the sale of inventory on.

From exohgcpop.blob.core.windows.net

Journal Entry For Inventory Received at Gladys McCoy blog Journal Entry For Selling Inventory On Account the accounting records will show the following bookkeeping entries for the sale of inventory on. an inventory journal entry is a type of accounting entry that is used to record transactions related to a company’s inventory. when you sell the $100 product for cash, you would record a bookkeeping entry for a cash transaction and credit the. Journal Entry For Selling Inventory On Account.

From procil.co.id

Mastering Business Inventory Accounts A Comprehensive Guide My Blog Information Journal Entry For Selling Inventory On Account This transaction transfers the $100 from expenses to revenue, which finishes the inventory bookkeeping process for the item. pots 'n things must also add a selling inventory journal entry to show a change in the assets it holds, so now the inventory. an inventory journal entry is a type of accounting entry that is used to record transactions. Journal Entry For Selling Inventory On Account.

From www.youtube.com

Journal Entry for Purchase of Inventory Professor Victoria Chiu YouTube Journal Entry For Selling Inventory On Account when selling inventory, a journal entry must be made to both debit cash or accounts receivable and credit sale. when you sell the $100 product for cash, you would record a bookkeeping entry for a cash transaction and credit the sales revenue account for the sale. pots 'n things must also add a selling inventory journal entry. Journal Entry For Selling Inventory On Account.

From www.wallstreetmojo.com

Sales Credit Journal Entry What Is It, Examples, How to Record? Journal Entry For Selling Inventory On Account when selling inventory, a journal entry must be made to both debit cash or accounts receivable and credit sale. an inventory journal entry is a type of accounting entry that is used to record transactions related to a company’s inventory. pots 'n things must also add a selling inventory journal entry to show a change in the. Journal Entry For Selling Inventory On Account.

From picturesgerty.weebly.com

Cogs journal entry picturesgerty Journal Entry For Selling Inventory On Account This transaction transfers the $100 from expenses to revenue, which finishes the inventory bookkeeping process for the item. when it comes to inventory accounting entries, you have a few options: when selling inventory, a journal entry must be made to both debit cash or accounts receivable and credit sale. the accounting records will show the following bookkeeping. Journal Entry For Selling Inventory On Account.

From mavink.com

Perpetual Inventory System Journal Entry Journal Entry For Selling Inventory On Account This transaction transfers the $100 from expenses to revenue, which finishes the inventory bookkeeping process for the item. an inventory journal entry is a type of accounting entry that is used to record transactions related to a company’s inventory. when it comes to inventory accounting entries, you have a few options: pots 'n things must also add. Journal Entry For Selling Inventory On Account.

From www.scribd.com

Perpetual Inventory System Journal Entries Journal Entry For Selling Inventory On Account an inventory journal entry is a type of accounting entry that is used to record transactions related to a company’s inventory. when you sell the $100 product for cash, you would record a bookkeeping entry for a cash transaction and credit the sales revenue account for the sale. when it comes to inventory accounting entries, you have. Journal Entry For Selling Inventory On Account.

From cedgaxft.blob.core.windows.net

Sold Inventory On Account Journal Entry at Betty Pitts blog Journal Entry For Selling Inventory On Account when it comes to inventory accounting entries, you have a few options: when you sell the $100 product for cash, you would record a bookkeeping entry for a cash transaction and credit the sales revenue account for the sale. when selling inventory, a journal entry must be made to both debit cash or accounts receivable and credit. Journal Entry For Selling Inventory On Account.

From animalia-life.club

Accounting Journal Entries For Dummies Journal Entry For Selling Inventory On Account when it comes to inventory accounting entries, you have a few options: when you sell the $100 product for cash, you would record a bookkeeping entry for a cash transaction and credit the sales revenue account for the sale. the accounting records will show the following bookkeeping entries for the sale of inventory on. pots 'n. Journal Entry For Selling Inventory On Account.

From www.youtube.com

Merchandising Buyer/Seller Journal Entries YouTube Journal Entry For Selling Inventory On Account an inventory journal entry is a type of accounting entry that is used to record transactions related to a company’s inventory. when you sell the $100 product for cash, you would record a bookkeeping entry for a cash transaction and credit the sales revenue account for the sale. the accounting records will show the following bookkeeping entries. Journal Entry For Selling Inventory On Account.

From accounting-services.net

Recording a Cost of Goods Sold Journal Entry ⋆ Accounting Services Journal Entry For Selling Inventory On Account an inventory journal entry is a type of accounting entry that is used to record transactions related to a company’s inventory. the accounting records will show the following bookkeeping entries for the sale of inventory on. This transaction transfers the $100 from expenses to revenue, which finishes the inventory bookkeeping process for the item. when it comes. Journal Entry For Selling Inventory On Account.

From www.youtube.com

Sales of Inventory Journal Entries Net Method YouTube Journal Entry For Selling Inventory On Account pots 'n things must also add a selling inventory journal entry to show a change in the assets it holds, so now the inventory. when selling inventory, a journal entry must be made to both debit cash or accounts receivable and credit sale. when you sell the $100 product for cash, you would record a bookkeeping entry. Journal Entry For Selling Inventory On Account.

From www.chegg.com

Solved Counted inventory and determined that 20 units were Journal Entry For Selling Inventory On Account when you sell the $100 product for cash, you would record a bookkeeping entry for a cash transaction and credit the sales revenue account for the sale. when it comes to inventory accounting entries, you have a few options: This transaction transfers the $100 from expenses to revenue, which finishes the inventory bookkeeping process for the item. . Journal Entry For Selling Inventory On Account.

From www.youtube.com

Perpetual Inventory Journal Entries Buyer & Seller YouTube Journal Entry For Selling Inventory On Account when you sell the $100 product for cash, you would record a bookkeeping entry for a cash transaction and credit the sales revenue account for the sale. This transaction transfers the $100 from expenses to revenue, which finishes the inventory bookkeeping process for the item. pots 'n things must also add a selling inventory journal entry to show. Journal Entry For Selling Inventory On Account.

From hadoma.com

Sales Return Journal Entry Explained with Examples (2023) Journal Entry For Selling Inventory On Account when it comes to inventory accounting entries, you have a few options: when selling inventory, a journal entry must be made to both debit cash or accounts receivable and credit sale. pots 'n things must also add a selling inventory journal entry to show a change in the assets it holds, so now the inventory. an. Journal Entry For Selling Inventory On Account.

From www.wallstreetmojo.com

Consignment Accounting Meaning, Example, How to Prepare? Journal Entry For Selling Inventory On Account when you sell the $100 product for cash, you would record a bookkeeping entry for a cash transaction and credit the sales revenue account for the sale. the accounting records will show the following bookkeeping entries for the sale of inventory on. when it comes to inventory accounting entries, you have a few options: pots 'n. Journal Entry For Selling Inventory On Account.

From accountingqa.blogspot.com

Accounting Q and A Appendix Ex 639 Journal entries using perpetual inventory system Journal Entry For Selling Inventory On Account when you sell the $100 product for cash, you would record a bookkeeping entry for a cash transaction and credit the sales revenue account for the sale. This transaction transfers the $100 from expenses to revenue, which finishes the inventory bookkeeping process for the item. the accounting records will show the following bookkeeping entries for the sale of. Journal Entry For Selling Inventory On Account.

From www.superfastcpa.com

What are the Journal Entries for Inventory Transactions? Journal Entry For Selling Inventory On Account the accounting records will show the following bookkeeping entries for the sale of inventory on. when it comes to inventory accounting entries, you have a few options: This transaction transfers the $100 from expenses to revenue, which finishes the inventory bookkeeping process for the item. when you sell the $100 product for cash, you would record a. Journal Entry For Selling Inventory On Account.